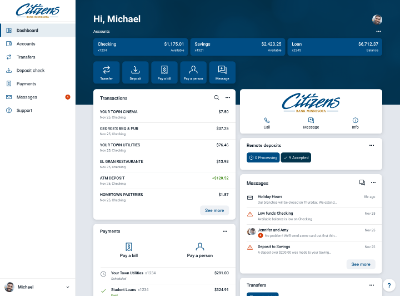

Online Banking and Bill Payment

Do your banking anytime, anywhere with Citizens Online Banking!

Our online banking is enhanced with two-factor authentication, which means no watermark or security questions, as we have had in the past.

Features:

- Check balances

- Transfer funds

- Pay bills

- e-Statements

- Message a bank representative

- Organize dashboard

- Re-name accounts

- Link another financial institution

Online Banking Alerts

Don't be caught off guard with your finances. Online banking users have the option to set up Alerts! You can set up Balance and Transaction Alerts, all from your online banking!

It's easy!

- Click on the account you want to set up alerts for

- Go to 'Settings' - 'Edit Alerts'

What is Voice Bill Pay?

A Voice Bill Pay skill, like iPay QuickPay, is a voice-driven capability that enables you to access certain information about your Citizens Bank Minnesota bill pay account on your Alexa-enabled device.

Once you’ve enabled the skill, you can ask Alexa to make a payment, provide payment history and check scheduled payments!

Who can I pay with iPay QuickPay?

- You are able to make a payment to eligible payees you’ve added to your bill pay account

- You can ask Alexa to list your payees if you are unsure of which payees you’ve added to your account

How do I get started with iPay QuickPay?

You will need an online bill pay account to start using iPay QuickPay. If you don’t have an account yet, log in to your account at www.citizensmn.bank and click the “Bill Pay” link to access the enrollment form.

Then you’ll need to add Alexa to your bill pay account. Here’s how:

- Log in to your account at www.citizensmn.bank and click the “Bill Pay” link

- Select the “My Account” tab

- Go to the Voice Bill Pay section and select the “Add Alexa” link

- Answer the challenge phrase questions

- Enter credentials and submit

This step completes the online setup.

Now it’s time to link your bill pay account to iPay QuickPay:

- Within the Alexa App on your mobile device, search for the iPay QuickPay skill and choose “Enable”

- When prompted, enter the credentials you created in bill pay to begin linking your bill pay account to iPay QuickPay

- Create a 4-digit PIN that you will remember since it will be requested every time you launch iPay QuickPay

- Select “I agree, Link Account” to complete the account linking process

- Now you can say, “Alexa, start iPay QuickPay”

How do I make payments with iPay QuickPay?

Just tell Alexa the payee you’d like to pay, the amount of the payment and the payment date.

Need help? Click here to see a short video and learn how to get started with iPay QuickPay.

Online Banking Text Alerts

Don't be caught off guard with your finances. Online banking users now have the option to set up Text Alerts! You can set up Personal Alerts, Item Alerts, Balance Alerts and Events Alerts all from your online banking!

It's Easy!

- Go to Options Tab --> Personal Options. Fill in the Mobile Phone Number and select a Wireless Provider Address.

- Go to Options Tab --> Alerts to add or edit an alert, and to enable Text as an option.

- Balance Text Alerts are sent throughout the day and all other alerts are sent after an update.

Cash Management

Sweep Business Account

Make the most of your money by having extra funds in your checking account automatically transferred to your business line of credit. Set the amount you want to keep in your account, and we'll move the rest for you so you don't even have to think about it anymore.

We'll check your account daily to make sure you maintain your target balance and sufficient funds are available to maintain day-to-day cash flow for your business. We can even sweep money from other banks to your Citizens accounts!

Summary

- Maximize returns

- Fully automated

- Secure transfers

Cash Concentration Accounts

If your business has multiple locations, you know what a hassle it can be to move funds from the outlying locations to the main office.

Utilize our cash concentration services to safely, conveniently, and cost-effectively move these funds so that you may invest, pay bills, or simply keep better track of your funds at a central location.

Summary

- Added convenience

- Completely secure

- Easier tracking of funds

Dividend Payment Direct Deposit

Similar to paying employees their wage electronically, many of our corporate customers are finding that stockholders prefer receiving their dividends automatically deposited to their checking accounts.

Direct deposit of dividends is easy to sign up for, and it helps your business avoid the hassles of processing and mailing paper checks, re-issuing lost or stolen checks, and dealing with dividend check reconcilement. Plus it's generally much less expensive than mailing checks.

Summary

- Secure electronic transfers

- Get access to funds sooner

- Safer than regular mail

Payroll Direct Deposit

Save money and time by signing up for direct deposit of payroll. It's easy to start, and you avoid the hassles of processing paper checks, re-issuing lost or stolen checks, hand-distributing checks to employees, and dealing with monthly check reconcilement. Plus, it's generally less expensive than processing paper checks if you have 15 or more employees.

Summary

- Save postage

- Save paper

- Eliminate handling costs

- Avoid reissuing checks

Direct Collections

Your business can benefit from a more assured and reliable collection of accounts from your regular customers, and more customers are demanding the convenience of being able to pay their bills via direct billing programs.

You get improved cash flow and reduce late payment issues while they enjoy more convenience and save on checks and postage. Direct collections from customers are a great way to make everyone happy.

Summary

- Improved cash flow

- Reduced collection costs

- Avoid returned checks

- Greater customer satisfaction

Remote Deposit

Remote Deposit Clover Go

Clover Go